Death and taxes: Why IHT problems might be solved by valuable protection

Death and taxes are two issues that all of our clients are guaranteed to face and it is highly likely that inheritance tax (IHT) in particular will make up a considerable part of their estate’s holistic planning strategy.

It can be a worry for many individuals, especially those who have worked hard and built-up substantial wealth and savings. However, it is important for clients to remain calm as there are plenty of potential options open to them.

One possible solution might be life insurance.

Holly Hill, one of our specialist brokers, recently wrote about the issue in The Month magazine. Holly proposes that: “Life insurance is one solution that advisers should be considering: both in terms of value for money but also, and more importantly, because insurance provides the liquid cash required to pay the tax bill”.

The current IHT landscape

In the last financial year (2021/22) HMRC reports that IHT receipts soared to a record high of £6.1 billion.

Furthermore, in the current financial year between April and December 2022, HMRC have already collected £5.3 billion in IHT payments; this represents a £700 million increase compared to the same period in 2021.

There are a variety of causes, not least the lasting impact on mortality rates caused by the Covid-19 pandemic.

But beyond this, HMRC cites recent increase in asset values, specifically property, alongside the government’s decision in March 2021 to maintain the nil-rate band (NRB) at its current level of £325,000 and the residence nil-rate band (RNRB) at £175,000 up to and including 2025/26.

There are a variety of IHT reliefs available; from Agricultural Property Relief and Business Relief through to qualifying charity donations and the NRBs, but each of these has stipulations attached.

Similarly, assets can of course be gifted (triggering a reducing liability to IHT over the following seven years) but typically the act of making a gift also triggers a Capital Gains Tax liability which can be avoided if the assets are moved on death.

Currently a married couple with an estate worth up to £2 million can pass on £1 million of estate assets without incurring an IHT charge; with each person having access to a £325,000 NRB allowance, combined with a further RNRB of £175,000 that applies when primary residencies are left to direct descendants.

For estates worth more than £2 million, the RNRB allowance is tapered away at the rate of £1 for every £2 that the estate is worth over £2 million, even if the primary residence is left to a direct descendant.

As property and other asset prices rise — dragged up by rising inflation — more than 23,000 families faced an IHT charge last year, and this number is only set to increase.

As a result, more of us need to start taking the 40% tax seriously.

A simple solution is to insure against the liability.

Life insurance can provide a cost-effective solution to a IHT problem

On death, life insurance can provide a cash lump sum to pay off the IHT immediately, allowing surviving family members to proceed swiftly with an application for probate without having to search for the cash themselves.

Furthermore, the liquidity provided by an insurance policy will protect chargeable illiquid assets from fire sale. In the case of large investment or property portfolios, this is a particularly helpful feature.

Insurance arrangements can be structured to suit any individual’s unique situation. By utilising term assurance, whole of life cover and a variety of enhanced product features, the planning can be entirely bespoke and work in conjunction with an individual’s wider tax strategy.

For example, term assurance (which lasts for a specific number of years or to a client’s set age) can be used to cover assets that will likely be transferred to the next generation during the client’s lifetime.

Alongside this, some whole of life cover (which has no expiry date) can then be used to protect against the IHT on those assets which will likely remain in the client’s estate up to their death.

Typically, this includes their main home and the assets that will be utilised to meet their ongoing income and care requirements.

Additionally, some insurers offer special features on their products that brokers can make use of to tailor insurance to client needs.

One useful example is where initial cover was taken out on a joint-life basis but a few years later a divorce has occurred. Here, some insurance providers will allow a joint-life policy to be split into two single-life covers without the need for any further underwriting on either spouse.

Additionally, certain policies come with a carve-out option which can be useful for parents wishing to pass assets to their children. The carve-out option allows the parents to make gifts and reduce the sum assured on their own policy accordingly. This results in a policy premium reduction too.

Assignment to trust

When a policy holder dies, the cash lump sums provided by any insurance policies held in their name will fall back into their chargeable estate.

It is therefore crucial that life insurance policies be assigned into trust – with the trustees becoming the policy holders and the life assured remaining the same – to avoid any pay-outs compounding the deceased’s IHT bill.

The assignment to trust can simply be done either by using a standard form provided by the insurance providers, or by utilising personal lawyers to draw up a bespoke deed.

Costs

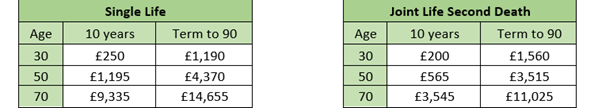

Current estimated costs per £1 million of cover:

Gift protection

Gifts from one generation to the next are always categorised as potentially exempt transfers (PETs) or chargeable lifetime transfers (CLTs) and trigger a liability to IHT that tails off over a seven-year period.

During this time, a sufficient quantity of liquid assets must be maintained to cover the IHT liability should it arise. This can cause problems if the recipient of the gifted assets wants to utilise them immediately, for example by buying a house.

One way to free up the gift is to purchase life insurance, known as gift-inter-vivos (GIV), to cover the potential liability. This provides both the donor and the recipient with peace of mind that the gifted assets will never need to be reclaimed for tax purposes.

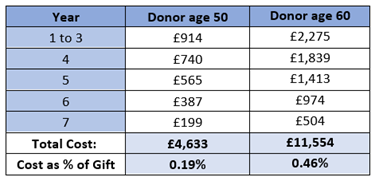

Gift protection is a very cost-effective option. For a £1 million gift which, excluding NRBs, comes with a potential liability of £400,000, the cost of insurance represents just 0.19% of the gifted amount for a 50-year-old donor, and just 0.46% for a donor aged 60.

Current estimated costs per £1 million of gift cover:

Read more: Estate planning for high-net-worth clients: life insurance as a cost-effective strategy

Get in touch

If you are interested in hearing more from Holly and learning how life insurance might benefit your own estate plans, please get in touch by email at [email protected] or by calling us on 020 7633 2222.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Other Insights

John Lamb Hill Oldridge featured in the Financial Times: Life insurance and inheritance tax planning

Our Associate Director, Holly Hill, was quoted in a recent article by the Financial Times exploring how changes to inheritance tax thresholds are prompting a closer look at protection-based solutions. You can find the article [...]

Podcast: Ken Maxwell discusses “A broker’s perspective on the underwriting challenges for high-value life cover” on IFA Talk

Director Ken Maxwell was recently invited to speak on the IFA Talk podcast, sharing a broker’s perspective on the underwriting challenges for high-value life cover. Ken covered a range of topics with hosts Sue and [...]

Using life insurance to cover the inheritance tax tail for a high-net-worth client’s gifting strategy

The client had made multiple gifts totalling £20 million and was seeking to cover the inheritance tax (IHT) liability over the next seven years. Lifestyle disclosures meant certain insurers would not offer cover. [...]