‘3 ways AI could transform the underwriting process’ by Darren Lee published in COVER Magazine

Artificial intelligence (AI) has been a regular feature in news headlines over the past year, as developments in the technology have begun to shape not only the future for many leading industries, but also the day-to-day lives of your clients.

AI has a wide range of benefits and can make previously time-consuming and complicated processes quick and simple.

It has not gone unnoticed in the protection industry, as AI has begun to transform the underwriting process.

Our very own Darren Lee, head of underwriting and claims at John Lamb Hill Oldridge, recently wrote for Cover magazine about how the future of underwriting will be impacted by advancements in artificial intelligence (AI) and three potential implications for the industry. Here are Darren’s thoughts.

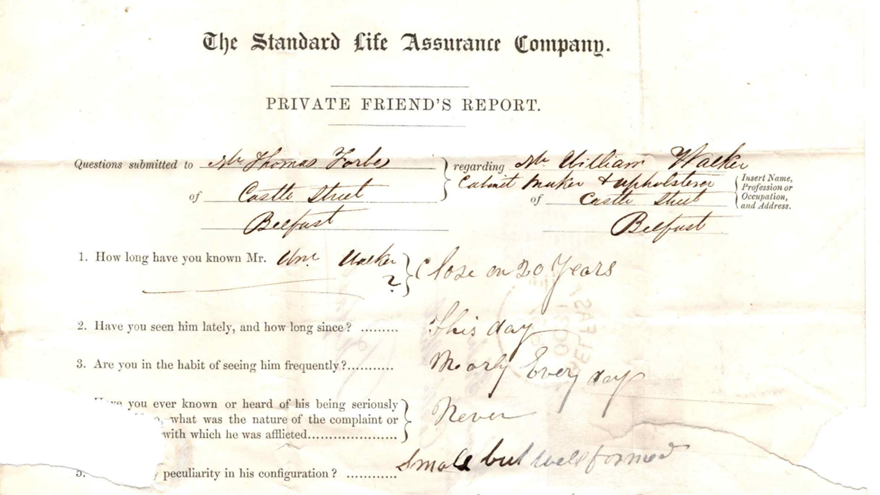

Underwriting as a process has remained largely unchanged since the Victorian era

The underwriting process typically requires the customer to complete a questionnaire about their lifestyle, medical history, hobbies, work, and anything else that could be relevant to the insurer. Certain responses might mean that the underwriters require medical reports or that the customer has a medical examination carried out to clarify the extent of the risk.

While the medical conditions the questions allude to might have evolved over time, if you compare the process we use today with that used back in the 1800s you would see many similarities. Indeed, apart from answering questions over the phone or on-line, there has been little fundamental change to the process in over 100 years.

AI comes in many different forms

When reading the term “AI”, you may think of recently released applications such as ChatGPT or Bard. These are examples of a “large language model” (LLM), a piece of software capable of presenting the answers to questions on a broad range of topics in conversational language.

Yet these are merely interfaces that allow a consumer to use AI for basic everyday tasks. While they are helpful tools, the AI transformers that power the LLMs are where the magic really happens.

These tools have been trained using online sources and platforms, giving them vast amounts of information to draw from when answering your questions. They can also learn from these sources to generate further suggestions and answers when these are not immediately apparent.

AI is a sophisticated piece of technology that may have the potential to change much more than the LLMs have so far. For sectors like underwriting, the potential implications could be significant.

3 potential implications of AI on the underwriting process

1. A more proactive and informed client base

Access to tools like ChatGPT or Bard means customers could become more proactive in challenging policies that offer non-standard terms. For example, they could ask an AI interface if it is “fair” that they should pay higher premiums for life insurance as a result of their health condition to learn more about the reasoning behind such decisions.

This could bring more scrutiny to the underwriting process for non-standard cases, requiring in-depth clarification on the reasoning behind decisions. If underwriting models themselves become more of a ‘black box’ where the algorithms driving outcomes are opaque this could result in customers feeling unfairly penalised if the underwriting rationale cannot be clearly demonstrated.

However, it is important for customers and underwriters to be aware of the weaknesses that LLMs currently have. They may be running on outdated or inaccurate information, and there have even been cases of fabricated data generated by the AI itself (sometimes referred to as the AI ‘hallucinating’). Without clarity from the models on what is factual and what is not, this could create difficulty on both sides of the relationship.

2. An end to the ubiquitous questionnaire

AI has opened up a world of opportunity in the form of data collection and interpretation. Wearables such as smart watches can track a customer’s blood pressure, temperature, and activity levels and provide many other health and lifestyle statistics.

Could this lead to a future in which data from these wearables automatically provide the underwriting information required, as opposed to completion of a questionnaire? If so, it could free up time for the customer and provide the underwriter with potentially more detailed and reliable information.

With this in mind, could AI eventually replace the need for an extensive questionnaire altogether?

This outcome would rely on the willingness of technology partners to supply this data.

Giants such as Apple, Google, and Meta hold the keys to vast amounts of data that could revolutionise the underwriting process. But their level of interest in the proposition is not clear, particularly in an industry as heavily regulated as insurance and where the product is often categorised as ‘sold not bought’.

3. Bespoke insurance offerings tailored to the individual

Data recorded by AI about a customer’s lifestyle and health could also lead to more bespoke insurance offerings.

Rather than relying on a limited range of fixed offerings, terms could be tailored to an individual’s needs for insurance that creates true peace of mind for a fair price.

In addition, value-added services could become much more relevant and helpful to the customer, relating to products and services that could be more closely linked to the risks, hobbies, and lifestyle of each individual.

In this way, AI could help ensure that life insurance policies enrich the customer’s life and actively improve their wellbeing (potentially even prompting health checks due to changes in the health metrics being recorded).

What are the next steps for AI and underwriting?

It is impossible to predict exactly how AI might disrupt the underwriting process. Changes could be seismic or incremental; they could happen next year, in 10 years, or maybe not at all.

Arguably, with so much opportunity and potential, it seems prudent to remain open to the possibility that this technology could fundamentally change the way we help our customers to protect what matters to them most.

With regards to predicting the future Elon Musk has been quoted as saying that “the most likely outcome will be the most entertaining one”! Who knows, perhaps AI will even make life insurance more fun!

Article published in COVER Magazine in July 2023.

Author: Darren Lee, Head of underwriting and claims at John Lamb Hill Oldridge.

Get in touch

If you’d like to learn more about the bespoke protection packages we can offer your clients, please email us at [email protected] or call us on 020 7633 2222.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Other Insights

John Lamb Hill Oldridge launches dedicated insurance-based investment products advice team

In recent months, many high-net-worth (HNW) individuals and families will have found themselves affected by changes to the Capital Gains Tax (CGT) rules and proposed reforms of the “non-dom” regime. To help advisers and their [...]

Holly Hill promoted to associate director

The UK’s foremost specialist protection adviser, John Lamb Hill Oldridge, has boosted its leadership team by promoting Holly Hill to the role of associate director. A former Team GB rower, Holly joined John Lamb Hill [...]

John Lamb Hill Oldridge wins gold at the Citywealth Magic Circle awards

Here at John Lamb Hill Oldridge, we are dedicated to providing the highest quality service to all of our clients. It is our mission to help them feel reassured about the future by arranging the [...]