‘Using life insurance as a tax planning tool’ by Holly Hill in ThoughtLeaders4 Private Client Magazine

Insurance can be highly effective when used as part of the client’s cash flow management profiling on death. In this article, we demonstrate how life insurance can be used in three tax planning scenarios.

Death and taxes are two guarantees for clients. Given the nature of private client work, it’s highly likely that inheritance tax (IHT) will be one of the taxes considered as part of an estates holistic planning strategy. Life insurance is one solution that advisers should be considering: both in terms of value for money but also, and more importantly, because insurance provides the liquid cash required to pay the tax bill.

Estate planning for IHT

Despite the varied reliefs available many individuals still face a large liability when passing their assets to the next generation. But as house prices continue to rise, impacting significantly on the value of personal estates, HMRC are collecting record numbers of IHT receipts. The Office for Budget Responsibility has forecast that in 2026- 27 they will be taking £8.1 billion in IHT revenue, up from £5.4 billion in 2021. As a result, more of us need to start taking the 40 per cent tax seriously. Life insurance can offer an affordable solution to inheritance tax planning. Not only does it protect illiquid assets, but, if the policy is placed into trust, the proceeds will be accessible pre-probate and can therefore be used to pay both the probate costs as well as providing a cash lump sum to pay off the IHT due immediately on death. This allows surviving family members to proceed swiftly with an application for probate without having the stress of searching for the cash themselves.

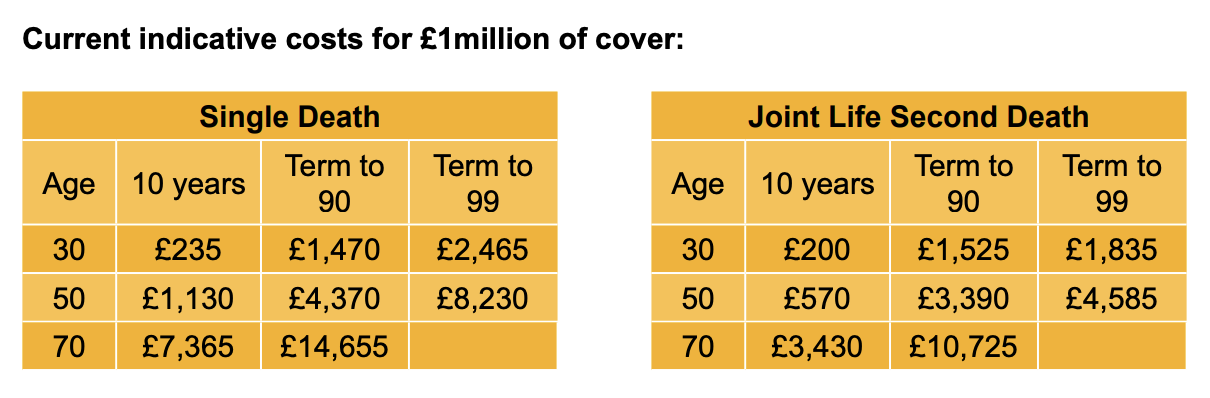

One of the most common policies used for IHT planning is a joint-life second-death, term to age 90 contract.

These structures are ideal for married couples because they are cheaper than single life contracts and take into account the inter-spousal exemption, where unlimited assets can pass to the surviving spouse free of IHT and insure against the liability that will arise on the death of the surviving partner. ‘Term to age 90’ means that the policy will pay out on the death of the second life assured providing that both deaths occur before the older life reaches, or would have reached, age 90. In the UK market, the longest term to age that can be purchased is to age 90. However, for clients seeking more comprehensive term cover, a term to age 99 contract can be sourced in the offshore market. The extra 9 years of cover works well for couples with a large age gap, or who have a family history of longevity beyond age 90. For permanent protection, the alternative to a term to 90 policy is a Whole of Life contract. These policies guarantee to pay out whenever the life assured dies, irrelevant of age or circumstance. They are the most thorough form of cover but, as a result of the increased risk to the life office, tend to be significantly more expensive.

Gifts and the 7-year tail

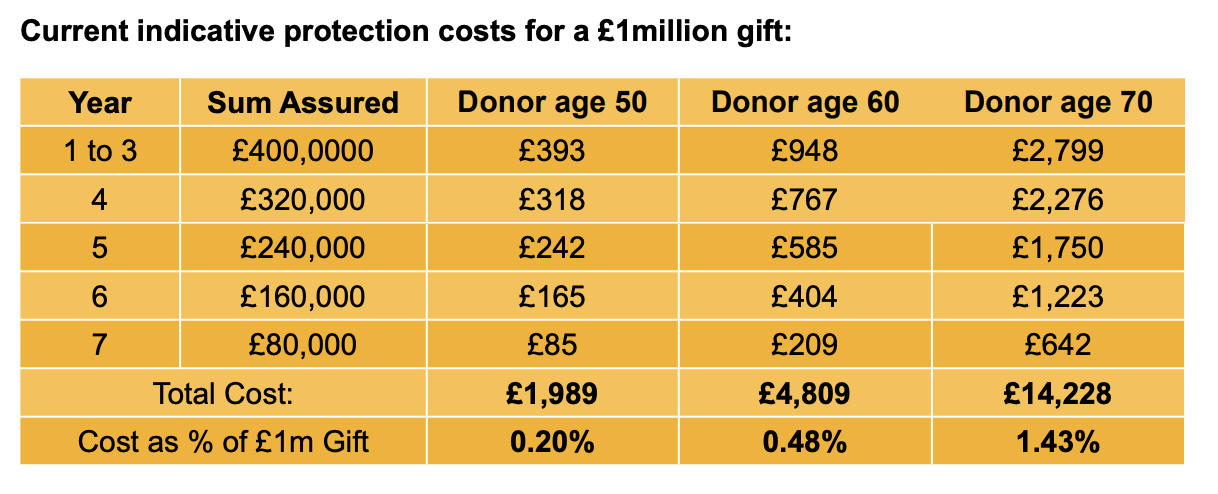

Gifts from one generation to the next are always categorised as Potentially Exempt Transfers PETs) or Chargeable Lifetime Transfers (CLTs) and trigger a liability to IHT that tails off over a 7-year period. During this time, a sufficient quantity of liquid assets must be maintained to cover the IHT liability should it arise. This can cause problems if the donee of the gifted assets wants to utilise them immediately, for example by buying a house.

One way to free up the gift is to purchase life insurance, to cover the potential liability. This provides both the donor and the donee with peace of mind that the gifted assets will never need to be reclaimed for tax purposes.

Gift protection is a very cost-effective option. For a £1,000,000 gift which, excluding nil rate bands, comes with a potential liability of £400,000, the cost of insurance represents just 0.20% of the gifted amount for a 50-year-old donor, and just 0.48% for a donor aged 60. We find it is often helpful for clients to view insurance as a definite c.0.5% cost versus a potential 40% charge.

IHT generated by the sale of a business

In all the furore of the sale of a business and the inevitable ‘deal fatigue’ that hits shortly afterwards, the long-term impact of having cash rather than BPR relievable shares on the IHT liability is often overlooked. For cash assets now with the client, there will be an immediate liability created. Similarly, there is often a series of gifts made shortly afterwards which will kick start the 7-year gift tail. For those assets that are gifted straight on, gift cover is available and is comparatively far cheaper than the potential tax liability that would arise on death. From a long-term planning perspective, ‘deal fatigue’ is likely to mean that clients would understandably like to take a break from long term planning. To protect them while they do this, it is sensible to put up an umbrella of cover up for 5 or 10 years just to provide some breathing space while you work out how to arrange the client’s assets for the future.

Author: Holly Hill, Senior Associate at John Lamb Hill Oldridge

Article published in ThoughtLeaders4 Private Client Magazine in February 2024.

Other Insights

Using life insurance to cover the inheritance tax tail for a high-net-worth client’s gifting strategy

The client had made multiple gifts totalling £20 million and was seeking to cover the inheritance tax (IHT) liability over the next seven years. Lifestyle disclosures meant certain insurers would not offer cover. [...]

Arranging life insurance for a married couple to cover their £3 million inheritance tax liability

The clients, a married couple in their 60s, had three children in their 20s The couple had a £3 million inheritance tax (IHT) liablity They were seeking whole-of-life cover for their joint life IHT [...]

New pensions taxation rules

In this video, Director Paula Steele explains how the taxation of pensions could change from April 2027. Please click here to view the full video