‘Could life insurance be an effective solution in some circumstances for contentious trusts?’ by Jonathan Morris in ThoughtLeaders4 Private Client Magazine

Trusts serve to oversee and manage assets throughout an individual’s life and often intergenerationally, normally for tax planning or safeguarding purposes. Despite their undoubted benefits sometimes contentious situations may arise prompting trustees to consider terminating trusts or advancing capital to current beneficiaries so that remaindermen can have their share of capital immediately. Breaking up trusts will have legal and financial implications, and it should be approached with caution, with individuals and trustees taking robust tax advice and a thorough assessment of the specific situation.

Potential reasons why trustees might choose to wind up a trust

- Irreparable conflict among beneficiaries

- Trustee mismanagement: Allegations or evidence of mismanagement, such as financial impropriety

- Disagreement on investment strategy

- Challenges to trust validity: legal challenges may prompt dissolution to avoid prolonged legal battles

- Significant changes since the trust’s establishment may render its terms obsolete

- Tax planning: dissolution may be driven by tax planning for some/all current beneficiaries

- Cost considerations: High periodic charges and administration costs may justify dissolution, particularly if the value of the trust has been depleted, whether through withdrawals, poor investment performance of inflation

- Desire for independence: Beneficiaries seeking greater autonomy and to gain control over the assets.

Below, I have explored two scenarios where life insurance could offer a solution for trustees, a life tenant and/or beneficiaries.

Case study 1 – gift of assets from the life tenant to the beneficiaries

An 80-year-old is the current life tenant of an Immediate Post Death Interest (IPDI) trust, established following the death of her late husband. A dispute has emerged between the widow and the children from his first marriage, stemming from their desire to access their assets immediately rather than waiting until her death.

In the event of distribution of all/part of the trust’s assets to the beneficiaries, these transfers will constitute a gift from the life tenant and will be treated as Potentially Exempt Transfers (PET) for inheritance tax (IHT) purposes, with a 7-year tail of IHT if the widow dies within this window. To mitigate potential IHT

liabilities on failed PETs, the life tenant, beneficiaries or trustees may consider securing insurance coverage for these gifts.

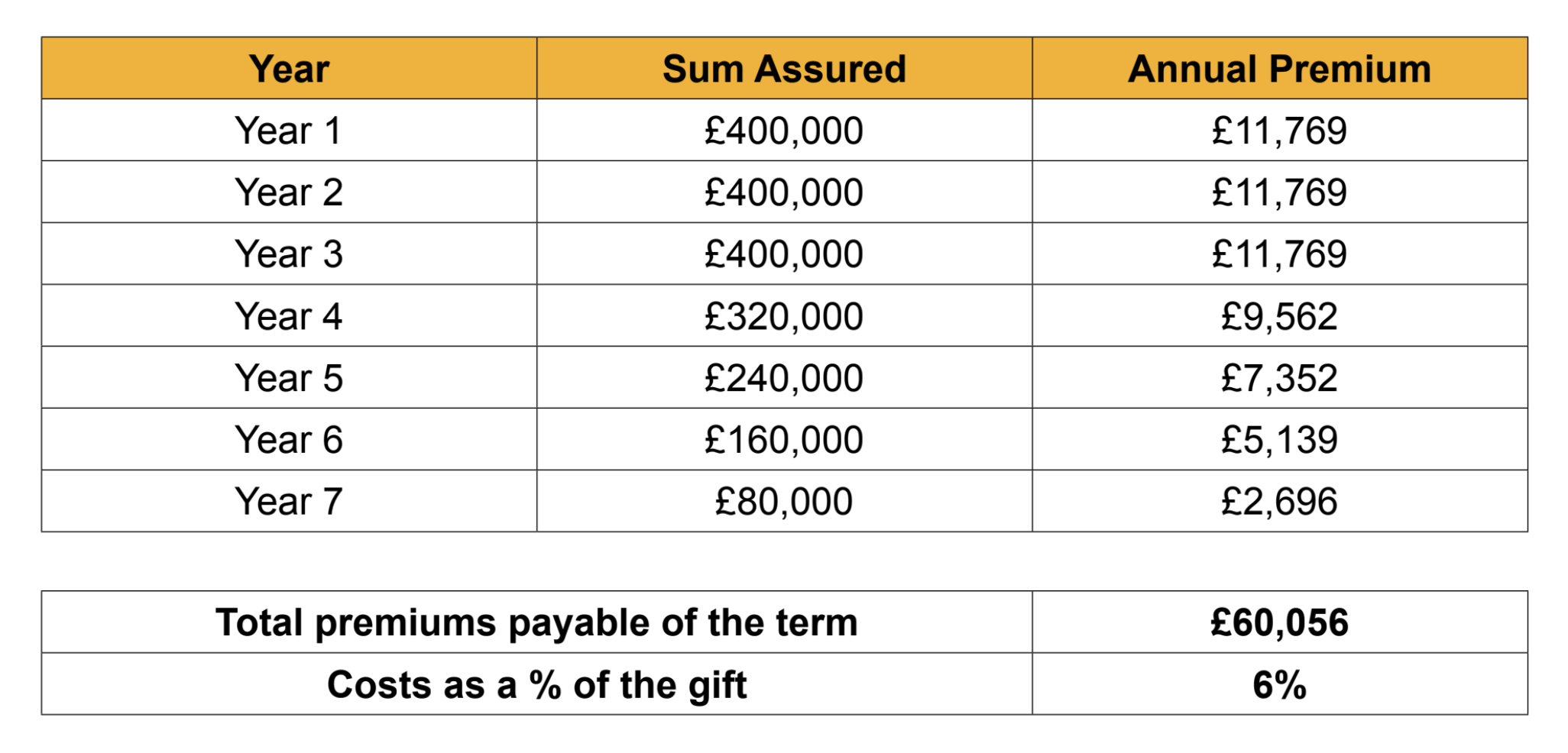

Outlined below are indicative costs for a life insurance policy that would provide cover for a gift of £1,000,000 from the life tenant, for an initial sum assured of £400,000 tapering after year 3 in line with the inheritance tax liability (£1,000,000 @ 40% IHT = £400,000 – without taking into consideration any Nil Rate Band that may be available).

80-year-old, female, non-smoker:

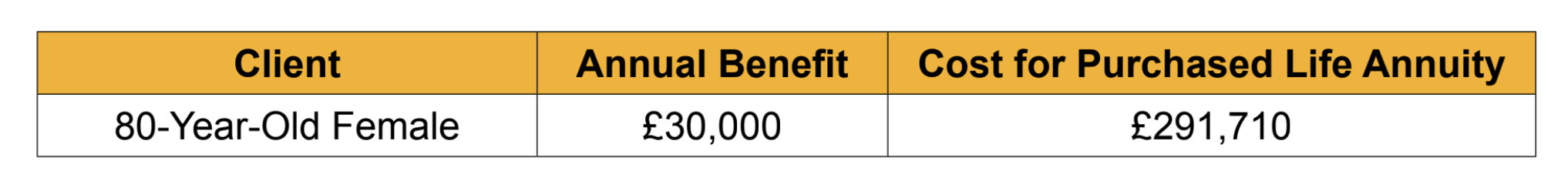

On termination of the whole/part of the widow’s entitlement there will be a loss of income. The beneficiaries/trustees and indeed the life tenant may wish to explore alternative measures for providing the lost income. One viable solution could be to procure a Purchased Life Annuity (PLA), which provides a continuous guaranteed income stream until the death of the annuitant. These annuities can incorporate annual escalation, ensuring that the income grows by a predetermined percentage each year.

Furthermore, as the income provided by PLA varies in line with interest rates and therefore now is an opportune moment to purchase.On termination of the whole/part of the widow’s entitlement there will be a loss of income. The beneficiaries/trustees and indeed the life tenant may wish to explore alternative measures for providing the lost income. One viable solution could be to procure a Purchased Life Annuity (PLA), which provides a continuous guaranteed income stream until the death of the annuitant. These annuities can incorporate annual escalation, ensuring that the income grows by a predetermined percentage each year. Furthermore, as the income provided by PLA varies in line with interest rates and therefore now is an opportune moment to purchase.

This approach could provide an accommodating solution for both the life tenant and the beneficiaries. Serving the dual purposes of facilitating the timely transfer of assets while safeguarding the financial wellbeing of the life tenant throughout their lifetime. The purchase of the annuity will lead to a loss of capital from the life tenant’s estate so there is an effective 40% IHT saving in addition.

Case study 2 – life insurance vs the periodic charge

Where you have trust funds for younger lives, trustees might want to consider both the impacts of the 10 yearly periodic charges and the annual accounting costs. When opting for a trust, the periodic charges and administration overheads can accrue overtime, potentially impacting the overall value of the assets held within

the trust. Moreover, the meticulous record-keeping and reporting obligations can add to the administrative burden, necessitating ongoing attention and resources. It can be useful to compare this to the costs of maintaining a life insurance policy.

Trustees may hesitate to release assets to younger beneficiaries due to concerns about their maturity and financial responsibility. Entrusting significant sum to inexperienced individuals could hinder their pursuit of financial independence and personal ambitions.

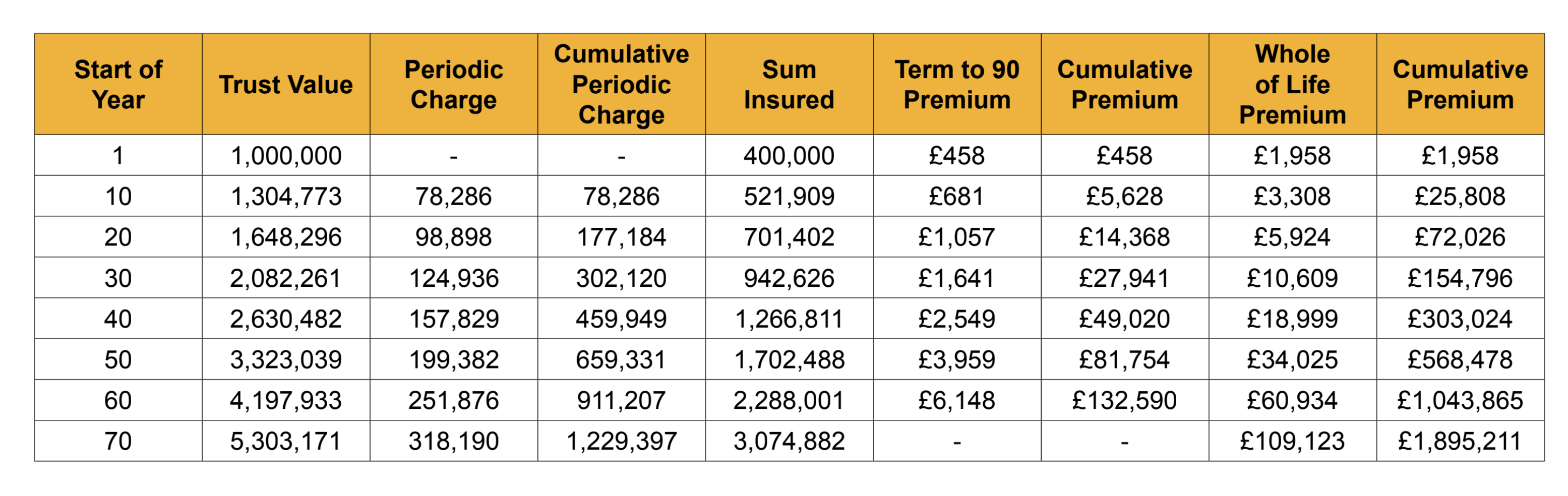

The below illustration is based on an initial trust value of £1m and an equivalent sum assured with IHT at 40% if the assets were not held in trust. We have assumed a fund growth rate of 3% annually and an equivalent 3% escalation rate of the sum assured, with premiums increasing by 4.5%. The client is a 26-year-old non-smoker.

When comparing the cumulative periodic charges with the cumulative premiums over both the short and long term, for a term life insurance policy running until age 90, the total cost of purchasing life insurance is significantly cheaper. Even when comparing the cost of purchasing a whole of life policy, the premiums would only surpass the cumulative periodic charges when the client reached age 79. Additionally, this comparison does not factor in any additional costs associated with the trust except the periodic charges.

As such, the overall trust charges may be higher meaning the costs of the whole of life cover could remain the cheaper option for longer.

Taking out a life insurance policy to cover the IHT liability on the assets can provide a simple and cost-effective solution in comparison to placing assets into trusts. Paying an annual premium of either £458 or £1,958, in this instance, is far more manageable and the planning is less complicated than co-ordinating the cash necessary for payment of a 6% periodic charge.

Secondly, depending on the assets within the trust, there may not be sufficient liquidity to pay the periodic charges. Illiquid assets, such as property, art portfolios or investments, may not generate regular income or easily convert into cash. As a result, trustees may face difficulty in raising the necessary funds to cover the ongoing and periodic charges. The illiquidity of certain assets can strain trust cash flow, demanding careful trustee financial planning. Life insurance offers a cost effective, easily administered alternative to asset retention in trusts.

Author: Jonathan Morris, Senior Associate at John Lamb Hill Oldridge

Article published in ThoughtLeaders4 Private Client Magazine in March 2024.

Other Insights

John Lamb Hill Oldridge launches dedicated insurance-based investment products advice team

In recent months, many high-net-worth (HNW) individuals and families will have found themselves affected by changes to the Capital Gains Tax (CGT) rules and proposed reforms of the “non-dom” regime. To help advisers and their [...]

Holly Hill promoted to associate director

The UK’s foremost specialist protection adviser, John Lamb Hill Oldridge, has boosted its leadership team by promoting Holly Hill to the role of associate director. A former Team GB rower, Holly joined John Lamb Hill [...]

John Lamb Hill Oldridge wins gold at the Citywealth Magic Circle awards

Here at John Lamb Hill Oldridge, we are dedicated to providing the highest quality service to all of our clients. It is our mission to help them feel reassured about the future by arranging the [...]