Arranging life insurance for a married couple to cover their £3 million inheritance tax liability

- The clients, a married couple in their 60s, had three children in their 20s

- The couple had a £3 million inheritance tax (IHT) liablity

- They were seeking whole-of-life cover for their joint life IHT liability.

The client’s circumstances

A couple approached the team at John Lamb Hill Oldridge as they needed support with covering a potential £3 million inheritance tax (IHT) liability. The couple was in their 60s with three children, each of whom was in their 20s.

The clients wanted to take out a whole-of-life policy to cover their joint life IHT liability.

Issues addressed

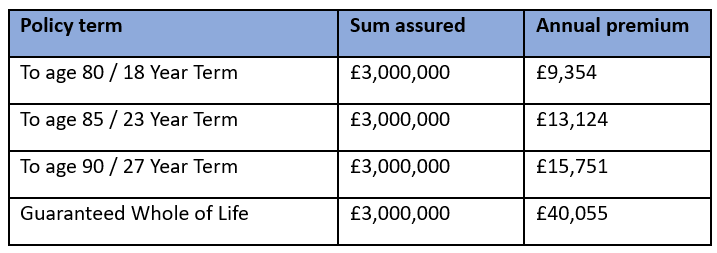

The cost of guaranteed whole-of-life cover for the full liability would have been high, as demonstrated by the below costings.

Joint-life indicative costs:

Tailored solution provided by John Lamb Hill Oldridge

Our team advised the clients to use a mixture of term and whole-of-life cover, with the term covers matching their future estate gifting plan; using a whole-of-life for the entire liability was not recommended because the clients have children whom they could gift the assets to.

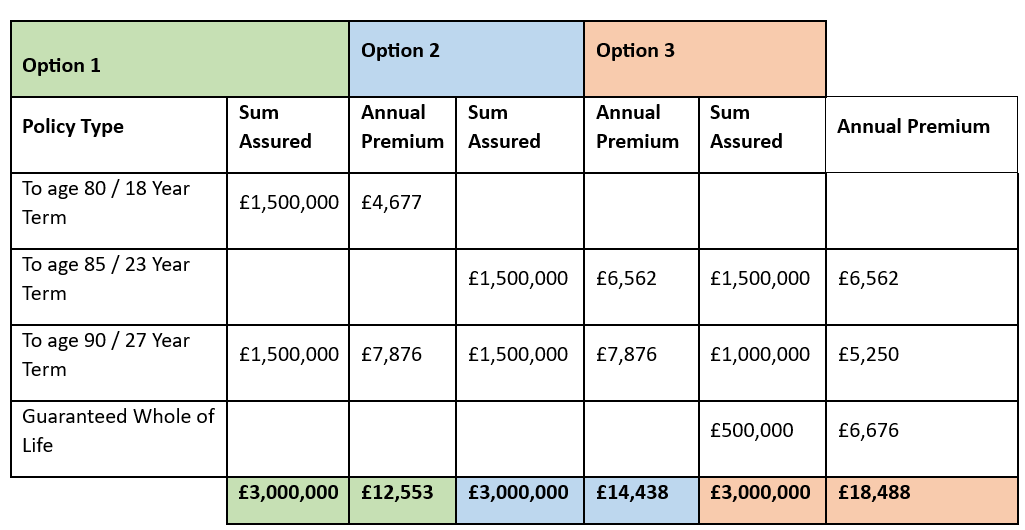

We provided some costed options (demonstrated below) to show how the client might split the full £3 million of protection over various term lengths.

Some costed options:

For larger estates like this one, we tend to create a portfolio of cover spread across different terms that broadly aligns with the estate’s gifting plan. This allows us to utilise the more cost-effective short-term covers for the bulk of the risk that will be passed on in life and only use the more expensive whole-of-life cover for the residual parts of the estate that clients will die either living in or living off.

For example, term to age 85 cover will protect the current liability as well as the 7-year tail on any assets that are to be gifted by the age of 78.

The clients were then able to choose their preferred option based on their budget and gifting plan and our team tailored a cost-efficient insurance portfolio to match this.