Protecting family businesses: Preparing high-net-worth and ultra-high-net-worth clients for the 2026 changes to Business Property Relief

As part of a client’s advice team, you have a pivotal responsibility in guiding business owners through the complexities of an evolving tax landscape.

With the government’s recently announced changes to Business Property Relief (BPR) taking effect from 6th April 2026, families who own and operate businesses face new challenges when passing assets from one generation to the next.

At John Lamb Hill Oldridge, we recognise how vital BPR has been in enabling family businesses to transfer ownership without triggering unaffordable tax bills.

As this relief becomes more limited, the risk of a significant inheritance tax (IHT) liability rises. With this on the horizon, life insurance continues to be one of the most practical tools available to protect business continuity and preserve family wealth.

Understanding the changes to Business Property Relief

BPR has traditionally provided up to 100% relief from IHT on qualifying business assets – such as shares in unlisted companies or interests in partnerships – allowing them to be passed down without triggering a large tax bill.

However, from 6th April 2026, BPR is set to be significantly restricted.

While full details are yet to emerge, information available so far suggests:

- A reduction in the rate of relief available (e.g., from 100% to 50%), including the introduction of a new threshold for 100% relief, potentially as low as £1 million.

- A narrowing of eligibility criteria – potentially excluding more investment-based business models and passive ownership structures.

- Greater HMRC scrutiny on what constitutes genuine trading activity versus investment.

These changes could mean that many family businesses once protected by BPR will now face substantial IHT liabilities on death, often without the liquidity required to pay them.

The risk to intergenerational business transfers

For families whose wealth is tied up in operational businesses, the dilution or loss of BPR could present significant problems:

- Unexpected IHT bills on death could force the sale of shares, property, or business assets.

- Succession plans may be disrupted, especially if heirs lack the capital to retain ownership.

- The stability of the business – and the livelihoods it supports – may be put at risk by short-term financial pressures caused by IHT demands.

This is particularly concerning for owner-managed businesses that had relied on full BPR relief as part of a wider estate and succession strategy.

Life insurance: A strategic solution for managing future IHT liabilities

With BPR relief becoming less generous, life insurance has never been more important. A properly structured policy can provide a tax-free lump sum at death – ensuring that IHT can be paid without having to break up or sell the business.

Here is how life insurance can help:

- Provide liquidity at the right time: Cover the IHT liability due on business assets, enabling a smooth transfer to the next generation.

- Preserve family ownership: Avoid the need for beneficiaries to sell shares or take on debt to meet tax bills.

- Enhance estate planning: When written in trust, the pay-out sits outside the estate, providing immediate access to funds without increasing the IHT burden.

Tailored insurance strategies for business owners

Different business structures require different planning approaches. Life insurance options that may suit business owners affected by BPR changes include:

- Whole of Life Cover: Permanent protection that ensures funds are available whenever the IHT liability arises. Ideal for family businesses with long-term succession goals.

- Relevant Life Insurance: A highly tax-efficient way for business owners to provide personal life cover through the company, with premiums typically allowable against corporation tax and no benefit-in-kind charge.

- Shareholder and Partnership Protection: Policies designed to ensure surviving owners or family members can buy out the deceased’s interest — protecting both the business and the estate.

- Business Trust Arrangements: Holding policies in trust ensures proceeds are kept outside the taxable estate, delivering funds quickly and efficiently.

Business protection as a cost-effective solution

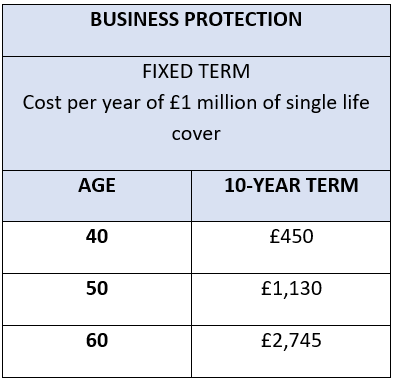

Due to the short-term length that is often taken for business protection, the policy premiums are often very affordable and allow an individual to effectively cover a large liability for a very affordable price.

The table below outlines current market rates for clients of a variety of ages for a 10-year term length for £1 million of cover. Relevant life policies have the added benefit of the premiums being deductible for corporation tax and a tax-free pay-out.

Adding value for your clients today

The upcoming BPR changes make it critical to review succession and estate plans now, not in 2026. As part of an individual’s advisory team, you have the opportunity to help your clients adapt early, safeguarding their family businesses and planning with confidence.

At John Lamb Hill Oldridge, we specialise in designing life insurance strategies that work alongside tax and legal advice. Whether your clients are looking to pass on a business, retain control within the family, or simply ensure financial stability for the next generation, we are here to help.

Next steps: Prepare now for the 2026 Business Property Relief changes

The time to act is now. We are here to support you and your clients with:

- Bespoke life insurance planning

- Succession protection strategies

- Guidance on integrating cover into wider estate and business continuity plans.

Life insurance can help protect your clients from the impact of the upcoming BPR changes, preserving both their business and their legacy.

Get in touch

Life insurance can provide a helpful and cost-effective solution to the changes to BPR and the tax regime for non-domiciled individuals. At John Lamb Hill Oldridge, our advisers are experts in offering bespoke insurance that supports high-net-worth and ultra-high-net-worth clients in protecting their wealth.

For more information about how we can help you to support your clients, please get in touch. Email [email protected] or call us on 020 7633 2222.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The Financial Conduct Authority does not regulate estate planning or tax planning.

Note that financial protection plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.

Other Insights

BUSINESS PROTECTION JANUARY 2026

Download Rates Table

GIFT COVER JANUARY 2026

Download Rates Table

Ken Maxwell quoted in ‘IHT, two-tier underwriting and client demands mean advisers remain vital – analysis’, article by Health & Protection.

We are pleased to see Ken Maxwell, Director at John Lamb Hill Oldridge, quoted in a recent Health & Protection article examining developments in the individual life insurance market and the growing role of protection [...]