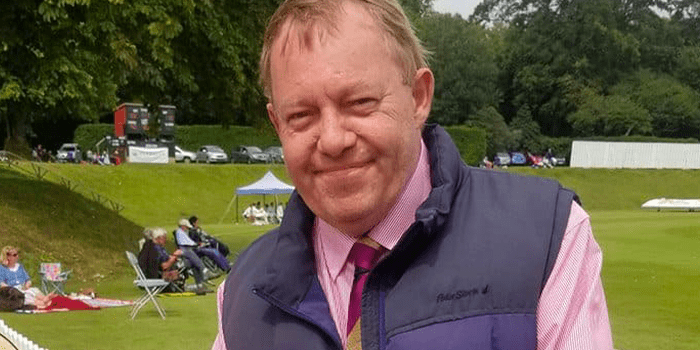

JULIAN HILL – IN MEMORIAM

Julian Hill, who founded Hill Oldridge, passed away earlier this year. He will be sadly missed by all those who knew him.

REMEMBERING JULIAN HILL

by David Pollock

Julian left school in 1978 and, after a brief flirtation with accountancy, he quickly found his natural home in the world of insurance broking. He first became involved with protection assurance at Richards Longstaff where he built a network of clients and connections, many of whom loyally followed him through a turbulent period in the late 1980s when the business he was working for changed hands on several occasions.

As a direct consequence, in 1992 Julian decided to branch out on his own and Hill Oldridge was formed, initially providing general financial advice, but latterly operating as a niche specialist protection assurance adviser. At the time of Julian’s death, Hill Oldridge was regarded as one of the premier firms for complex life assurance placements and acted for more than 80 landed estates and their families.

Julian was a larger than life character who never missed an opportunity to mix business with pleasure! Whether hosting his business contacts at the Oval or entertaining the local professionals at VATs Wine Bar in Holborn, Julian was unfailingly courteous and engaging. The warmth of the many tributes received from his clients after his untimely passing show that he was as much regarded for the outstanding quality of his work as for being a true gentleman in the very best sense.

Other Insights

‘Such is life’ by Paula Steele in STEP Journal

It has been ten years since the UK’s Retail Distribution Review (RDR) was implemented, which changed the landscape for life insurance policies significantly. Many clients are unaware of what their policies provide and/or can do. [...]

‘Could life insurance be an effective solution in some circumstances for contentious trusts?’ by Jonathan Morris in ThoughtLeaders4 Private Client Magazine

Trusts serve to oversee and manage assets throughout an individual’s life and often intergenerationally, normally for tax planning or safeguarding purposes. Despite their undoubted benefits sometimes contentious situations may arise prompting trustees to consider terminating [...]

‘The Crucial Role of Women in Private Client Industry Growth’ by Alex Gibson-Watt published in IFA Magazine

The theme of this year’s International Women’s Day was to ‘inspire inclusion.’ In today’s rapidly evolving business landscape, as an industry we are increasingly realising the significance of diversity and inclusivity, with a particular emphasis [...]