‘Keeping art and luxury items in the family’ in The Month magazine by Jonathan Morris

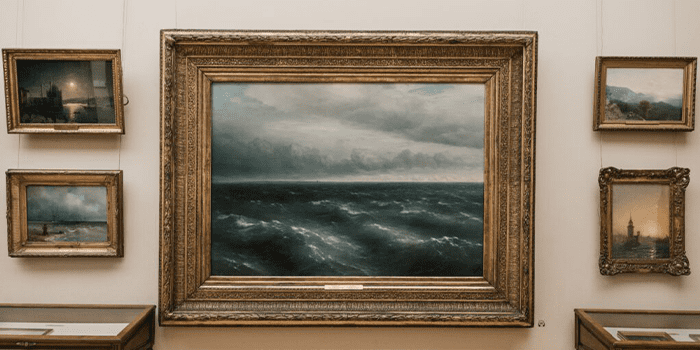

Art and luxury items are bought for a variety of reasons; sometimes as a store of value, sometimes with a view to capital gain, but often, simply because the purchaser loves what they’re buying. Typically, with ownership comes knowledge and interest in the item itself and its history. Once the love affair with a particular item or collection has started any loss can be devasting, especially if the long-term intention was to have the items enjoyed by future generations. As luxury art and goods tend to significantly increase the value of the owner’s estate, their possession can lead to enhanced liability to inheritance tax (IHT). To protect against the asset needing to be the subject of a fire-sale in the event of a liquidity issue on death, many owners choose to insure the value of their assets against loss, whether that loss is due to fire/theft (dealt with as part of household insurance) or a tax charge on death.

What happens to the assets on death?

On death, an individual’s estate will be subject to a 40% inheritance tax charge on any value above the available nil rate bands and reliefs. The IHT charge must be paid before probate is granted and, unfortunately, given that luxury items are relatively easy to sell, they are often the ones used to provide the funds to pay the bill.

If the owner wants the piece of art or a luxury item, which can often form part of a collection, to be passed on to their beneficiaries, the tax needs to be funded in another way. Life insurance can be purchased to match the existing IHT liability, with a policy designed specifically to provide the liquid cash required to pay the tax bill to HMRC.

How can assets be passed on?

Assets can be passed to future generations or beneficiaries in two ways. Either via the execution of a will on death or as gifts made during the individual’s lifetime. Those who choose to pass on assets during their lifetime enjoy the added benefit of seeing their beneficiaries enjoy the items and also watch their interest and knowledge in the subject grow.

In both instances, life insurance can provide a cost-effective solution to the potential IHT problem.

For assets passed on death, a long-term life insurance policy can be taken out to cover the IHT liability on an individual’s estate, including any art and luxury goods. The policy will pay-out a cash sum, providing the beneficiaries with money to pay the 40% IHT charge. Not only does this remove some of the stress at a difficult time, it also enables probate to be granted quickly and permits the entire estate to passed on to beneficiaries without the need to break up collections or sell the family’s prized assets. For example, a policy protecting a 60-year-old couple’s £1million art portfolio, by providing a £400,000 pay-out, would cost around £2,160 per year through to age 90.

Alternatively, if items are gifted during an individual’s lifetime, a life insurance policy can be implemented to mirror the decreasing liability to IHT throughout the 7-year tail. This type of policy is known as a gift-inter-vivos policy and has the distinct advantage of creating a ‘closed gift’. If the donor dies within 7 years of making the gift, the value of the item is returned to the donor’s estate for the purposes of IHT calculations. However, if any IHT is deemed to be due on the gift, it falls to the beneficiary to pay it. A gift-inter-vivos policy provides the funds to pay this tax, ‘closing’ the gift and allowing the beneficiary to enjoy the gift without future risk.

Gift cover is a very cost-effective option. At age 60, you can make the gift IHT-protected at a cost of around 0.5% of the gift’s value. To cover the potential liability on the gift of a portfolio worth £1,000,000, the estimated cost would be:

| Age 60 | Age 70 | |

|---|---|---|

| Year 1 | £1,116 | £3,161 |

| Year 2 | £1,116 | £3,161 |

| Year 3 | £1,116 | £3,161 |

| Year 4 | £857 | £2,435 |

| Year 5 | £623 | £1,760 |

| Year 6 | £413 | £1,134 |

| Year 7 | £206 | £567 |

| Total Paid | £5,448 | £15,379 |

| Cost as a % of the gift | 0.54% | 1.54% |

Article by Jonathan Morris, Protection Specialist at John Lamb Hill Oldridge, published in The Month magazine (September 2022).

Other Insights

New pensions taxation rules

In this video, Director Paula Steele explains how the taxation of pensions could change from April 2027. Please click here to view the full video

Changes to IHT

In this video, John Lamb Hill Oldridge Director Paula Steele summarises the proposed changes to inheritance tax that were outlined in the Budget in October 2024. Please click here to watch the full video [...]

‘How advisers can use protection specialists to better serve clients’ by Ken Maxwell published in FT Adviser

In the ever-evolving world of financial services, wealth accumulation is no longer the sole focus of advisers. Today, clients demand a more holistic approach to their financial wellbeing; one that also includes risk management and [...]