What cancer diagnosis delays mean for the life insurance market and how it can affect your clients’ cover

The last few years of global events have felt like a series of dominos colliding as each new issue inevitably gives rise to a further problem. It has made for an unforgiving and uncertain climate, one in which the necessity of insurance is increasingly evident.

For many across the healthcare and insurance sectors, this rings true for an unfortunate side-effect of the Covid-19 pandemic — the inevitable delay in other treatments such as cancer diagnoses.

Covid-19 has pushed the NHS to capacity and led to lengthy delays in initial cancer referrals

The burden and strain the pandemic has put upon the NHS has led to many treatments, outside of urgent care responsibilities, experiencing significant delays.

The British Medical Association (BMA) released a report on NHS backlog analysis and drew the conclusion that it would take years for the health service to clear its current backlog.

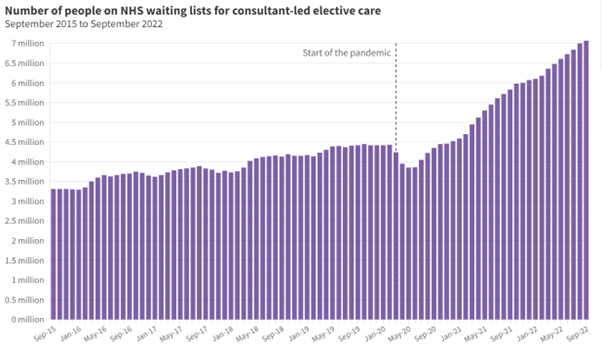

The BMA’s graph below details the number of people on NHS waiting lists for consultant-led elective care since September 2015.

Source: BMA

While NHS wait times were already high pre-Covid, with 4.43 million on waiting lists in February 2020, they have since spiked to a record high of 7.3 million patients waiting as of September 2022.

The backlog has led to:

- 401,537 patients waiting over a year for treatment – 308 times more than September 2019

- A median waiting time for treatment of 14 weeks, significantly longer than pre-Covid

- Patients receiving cancer consultation appointments and first treatments within set target time frames coming in at 73% in September 2022, 20% below the target 93% threshold, and the lowest on record.

The knock-on effect of the pandemic on the diagnosis and treatment of cancer patients, has been significant.

The time taken between referral, initial consultation, and treatment remains well below the NHS’s set operational standard.

Early diagnosis is key to your long-term health and delays can affect your insurance in a variety of ways

When it comes to cancer treatment, it is absolutely vital to catch it early. The difference can literally be the difference between life or death.

One of the problems resulting from delays to initial oncology consultations is that cancers that might previously have been caught at stage one or two, are now progressing to stages three or four before they are discovered.

This greatly reduces a patient’s likelihood of survival and is likely to require far more extensive and aggressive treatments.

A delay in cancer diagnosis can also complicate insurance matters, as for many individuals’ insurance provides a safety net that may be vital if they fall critically ill. Dependent on the details of the cover involved, it may include provisions for critical or terminal illness that would allow the holder to make a claim while they are still living.

However, without an official diagnosis, the claim process cannot begin.

Macmillan’s study into cancer care during the pandemic, known as “The Forgotten C”, found that while 18,400 people in England had their cancer diagnosed at stage one between March and June 2019. This figure dropped by 33% to 12,400 in the same period in 2020.

The research also showed an increase in late diagnoses. For example, women being diagnosed with stage four breast cancer saw a 48% rise in the first few months after the pandemic began.

Macmillan’s finding concluded that the NHS would need to work at 110% capacity to clear the current cancer backlog, which would in turn take 18 months to catch up on missed cancer diagnoses’ and 15 months for delayed cancer treatments.

Life insurance is never more essential than when you have received a life-threatening diagnosis

Life insurance is the ultimate safety net. It can not only provide for you under difficult diagnostic circumstances, but it is also there for the added peace of mind that should you die, your loved ones will receive financial support.

While it is still possible to take out cover after a cancer diagnosis, the condition will count as “pre-existing”, and will likely lead to significantly higher premiums. So, being proactive with obtaining cover can not only provide you with emotional wellbeing benefits but could also reduce future costs should you be diagnosed with any serious ailments.

As mentioned in our article on the pandemic’s wider effects on the insurance market, one of the main effects related to the insurance process has been on underwriting.

Read more: How the pandemic has affected life insurance rates and what you need to know

It is yet another reason why beginning an application as soon as possible is so important, as the underwriting process has not been under such strain in living memory.

The John Lamb Hill Oldridge process can speed up your insurance journey

One key benefit of working with John Lamb Hill Oldridge is that we offer clients access to our own in-house underwriter. He is familiar with the requirements of insurers, their premiums, and the loadings they are likely to impose upon a client’s policy.

This can greatly improve the experience of our clients and helps to smooth out any added complications that often arise when placing insurance high net worth (HNW) or ultra-high net worth (UHNW) individuals.

Read more: Why it’s so important to seek specialist advice when arranging high net worth life insurance

At John Lamb Hill Oldridge we understand that every client is an individual with different needs and circumstances. Our clients embark on a bespoke journey with us across eight key stages:

- Explore: we review solutions with clients free of charge and with no obligation

- Assessment: we offer clients a confidential, no obligation, in-house meeting with our underwriter

- Medical: we organise a medical examination and a doctor’s report undertaken at the clients’ time and place of choosing

- Financial: we gain a greater understanding of a client’s financial information, inheritance tax implications, and any outstanding debts

- Broking: we negotiate with providers on our clients’ behalf

- Final terms and application: we send proposed terms and premiums to the client for approval

- On risk: the agreement is placed “on risk” while all relevant documentation is sent to the client

- Writing into trust: where appropriate, we ensure that the policy is either written in or assigned in to trust to maximise tax efficiency.

Get in touch

One in two people in the UK will at some point in their lives develop a form of cancer, with 375,000 new cancer cases arising each year. Every month delayed in cancer treatment can raise the risk of death by approximately 10%.

It is vital that if you are starting the process of obtaining cover, you do so as soon as possible, and with the benefit of professional advice. If you are a HNW or UHNW individual this becomes even more important, and you should seek expert input by emailing us at [email protected] or by calling us on 020 7633 2222.

Please note

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Other Insights

‘Such is life’ by Paula Steele in STEP Journal

It has been ten years since the UK’s Retail Distribution Review (RDR) was implemented, which changed the landscape for life insurance policies significantly. Many clients are unaware of what their policies provide and/or can do. [...]

‘Could life insurance be an effective solution in some circumstances for contentious trusts?’ by Jonathan Morris in ThoughtLeaders4 Private Client Magazine

Trusts serve to oversee and manage assets throughout an individual’s life and often intergenerationally, normally for tax planning or safeguarding purposes. Despite their undoubted benefits sometimes contentious situations may arise prompting trustees to consider terminating [...]

‘The Crucial Role of Women in Private Client Industry Growth’ by Alex Gibson-Watt published in IFA Magazine

The theme of this year’s International Women’s Day was to ‘inspire inclusion.’ In today’s rapidly evolving business landscape, as an industry we are increasingly realising the significance of diversity and inclusivity, with a particular emphasis [...]