Guaranteed whole-of-life assurance: here is why it might be an attractive option

Guaranteed whole-of-life assurance contracts have come back into the limelight recently. They offer high internal rates of return guaranteed not only by the issuing insurer, but also by the Financial Services Compensation Scheme (FSCS), which provides a guarantee on contractual sums insured without limit in the event of the failure of an insurer.

The returns on guaranteed whole of life policies are tax-free.

Additionally, contracts can be placed outside the estate of the policy owner by being placed in trust so the returns will be outside the Inheritance Tax (IHT) net.

Here’s how guaranteed whole-of-life assurance works

The client takes out a life insurance contract guaranteeing, either on a single or joint lives, on the second death of a couple, a sum insured payable on the second death of the lives insured.

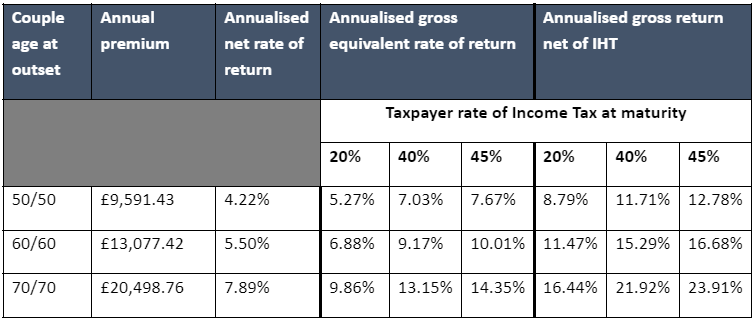

It is possible to accurately calculate the rate of return that will be achieved based on a specified age at death. This return will be tax-free regardless of the tax rate of the policy holder.

For the purposes of this note we have assumed a payout of £1m and that the younger life dies at age 90.

The policy would typically be placed in trust so that the return will be IHT free as well as Income and Capital Gains Tax free. Where insurance policies are placed in trust the “gift” is the annual premium paid, not the sum insured.

Premiums up to £3000 each year would be covered by the Annual Allowance, if it hasn’t been used elsewhere. For a couple this gives an allowance of £6,000 each year.

Premiums over this amount may be covered by the surplus income provisions. If this is not the case, the premiums will be set against the nil-rate band (which stands at £325,000 as of the 2023/24 tax year) until that is used up. Anything above the threshold will be a chargeable lifetime transfer and potentially subject to a lifetime chargeable transfer rate of 20%.

However, if clients have this issue, or think they will in the future, then in many cases the premium can be structured to be a “potentially exempt transfer” (PET).

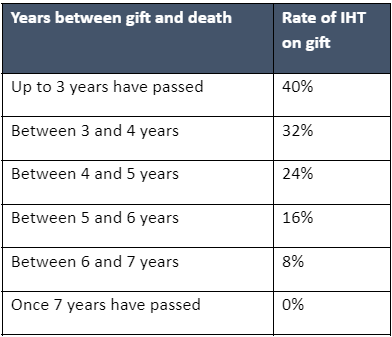

A PET is typically IHT-free seven years after the gift is made. If your clients die within three years of making the gift it is normally liable for IHT at the rate of 40%. But once three years have passed, the rate tapers year-on-year until the gift becomes IHT-free after seven years have passed, as shown by the table below:

Policies can be written with indexation options, so that the sum assured can increase in line with inflation or a fixed rate of increase. Although, the cost of the increase will be at a higher rate of increase than the increase in the sum assured.

Many people buy term insurance through to age 90 when planning for IHT as the costs are significantly lower for the sums insured secured. However, these contracts come to an end when the older life reaches or would have reached age 90 if they are already dead.

Age 90 is the oldest possible age for term insurances in the UK market.

If the second life insured has not died by that point, then there will be no payment made. When a couple are of similar age this can be seen as acceptable.

If one party is significantly younger, the likelihood of a payout is reflected in the premium. But for a couple aged, for example, 70 and 60, there will only be a payout if they have both died by the time the older party is, or would have been, aged 90. This means the younger party needs to have died before the age of 80, which is well below average life expectancy.

Many clients are concerned with regard to the ongoing funding of premiums, as they may feel they are affordable at present but not in the long term. Allocating a relatively small amount of capital, typically 20 times the annual premium, can be made to tax-efficiently fund the premium, so that it doesn’t have to be funded from ongoing income.

Read more: Death and taxes: Why IHT problems might be solved by valuable protection

The team at John Lamb Hill Oldridge are here to guide your clients through the process

Life assurance or insurance can be a complicated matter, but one that is essential to your clients’ estate plans and helping them to provide for their beneficiaries once they’re dead. Whole-of-life contracts have a wide range of respective benefits and might be the right fit for your clients’ personal circumstances.

To discuss whether that’s the case or if another option might suit their needs more, they should reach out to us by email at [email protected] or by calling us on 020 7633 2222.

Please note

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Other Insights

John Lamb Hill Oldridge launches dedicated insurance-based investment products advice team

In recent months, many high-net-worth (HNW) individuals and families will have found themselves affected by changes to the Capital Gains Tax (CGT) rules and proposed reforms of the “non-dom” regime. To help advisers and their [...]

Holly Hill promoted to associate director

The UK’s foremost specialist protection adviser, John Lamb Hill Oldridge, has boosted its leadership team by promoting Holly Hill to the role of associate director. A former Team GB rower, Holly joined John Lamb Hill [...]

John Lamb Hill Oldridge wins gold at the Citywealth Magic Circle awards

Here at John Lamb Hill Oldridge, we are dedicated to providing the highest quality service to all of our clients. It is our mission to help them feel reassured about the future by arranging the [...]