‘Inheritance tax considerations on the sale of a business’ by Holly Hill published in The Month magazine

In the following article, published in The Month magazine, Holly Hill, senior associate at John Lamb Hill Oldridge, explores the potential implications of the sale of a business on future inheritance tax (IHT) liability. She also shares how life insurance can offer cost-effective options for both short- and long-term IHT planning.

Inheritance tax considerations on the sale of a business

In all the excitement of the sale of the business, the long-term impact of having cash rather than shares in the unquoted trading company on the IHT liability is often not addressed. In terms of presale planning, often there will be a transfer into a relevant property trust in the certain knowledge that the value transferred will become chargeable if the transferor dies within seven years.

Similarly, for cash assets that are now with the client, there is an immediate IHT liability created. Additionally, there is often a wish to transfer assets to the children in both the short and the long term, which will again instigate the IHT gift tail.

The life insurance industry has cost-effective solutions to both short- and long-term IHT planning.

Gifts and transfers to trust

For the transfer of qualifying unquoted shares into a relevant property trust, there is no immediate IHT payable and normally there will be Capital Gains Tax holdover relief. The clock for the seven-year IHT tail will also start ticking from the date of transfer.

Therefore, if the assets are moved into trust and the sale is subsequently made a year down the road, there is only a six-year reducing liability to IHT.

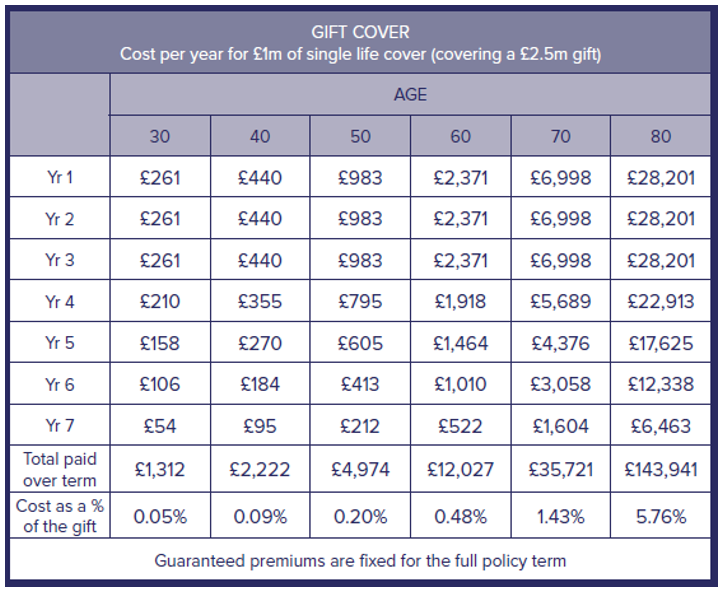

For a client aged 60, the total cost of life insurance to cover the six-year tail would be just 0.4% of the assets transferred. Advisors can save clients significant amounts of money by ensuring that the gift maker, and therefore the insured person, is as young and as healthy as possible.

You should therefore consider whether the assets can be passed to a younger (and potentially fitter) spouse before being moved into trust or gifted.

Following the sale, gifts can also be made directly to the children and grandchildren and again the overall cost compared to the potential IHT liability is negligible. Clients can view insurance as a definite cost of approximately 0.5% compared to a potential 40% tax.

The overall cost over seven years for a client who is 70 years old is still under 1.5% of the gifted amount.

Long-term inheritance tax liability

Clients will also have long-term IHT liabilities that they may be happy to retain within the estate, effectively self-insuring.

Alternatively, long-term insurance can often be a flexible and cost-effective solution to protecting the family assets. In the UK market, term cover can be purchased up to a maximum age of 90, or clients can opt for a guaranteed whole-of-life policy that will provide permanent protection. Typically, estates will opt for a mixture of these two options for cost control purposes.

If we look beyond UK waters, the international market offers a term to age 99 contract which is not only comparatively well priced, but which also works very well for clients with longer-than-average life expectancies.

It can work where couples seeking joint-life policies have a significant age gap (since term policies will terminate when the older life reaches, or would have reached, the designated age on the contract). Similarly, there are a range of flexible and investment-based options available through the US market.

Additionally, clients may also be considering future gifting, recognising that as they get older they may want smaller houses, fewer yachts, and to hang up the private pilot’s license. For these clients, buying a contract that allows you to insure your current liability on a joint-life-second-death basis, but to then split the cover down into single-life policies if gifts are made or there is matrimonial strife, provides excellent flexibility.

Who pays the premiums?

Life insurance policies purchased for IHT protection will need to be held outside of the life assured’s estate. This can be achieved either by taking out the policy on a “life of another” basis, for example where a child takes out cover on their parents, or by assigning the policy into trust. In both cases, consideration will need to be given to who will be responsible for paying the premiums, and importantly, to how the payment of premiums will be enforced in the long term. The latter can sometimes be an issue where multiple siblings receive gifts and some dutifully maintain gift cover while others do not, leaving a cash void if the tax does end up falling due.

There are various options and considerations for premium payments:

- The donor

- If the policy is owned on a life of another basis, then premium payments made by the donor will be considered to be potentially exempt transfers (PETs). If the policy is held in trust, then premiums will be considered to be either PETs or chargeable lifetime transfers (CLTs) depending on the type of trust.

- Where premiums are high enough to exceed the nil-rate band, the tax implications will need to be considered. To navigate this, premiums can be covered, where appropriate, by:

- The £3,000 annual gift allowance

- The normal expenditure from income exemption.

- The donee

- Where a donee is happy to fund the premiums themselves, there are no PET/CLT issues, but care must be taken to ensure that the donee continues to pay for the cover if the estate is relying on the policy to foot the IHT bill.

Summary of considerations:

- Remember that business sales come with a sudden and significant IHT exposure.

- For married couples gifting, try to pick the youngest and healthiest spouse to make the gifts.

- Consider who will be responsible for paying the premiums and what the tax implications are, and ensure controls are in place to maintain the premium payments into the future to avoid a lapse in cover and a cashflow void.

Get in touch

If you would like to learn more about how John Lamb Hill Oldridge can help you to support your high-net-worth clients to mitigate their future IHT liability after selling their business, please get in touch. Email [email protected] or call us on 020 7633 2222.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Please do not act based on anything you might read in this article. This article is no substitute for financial advice. You should seek a professional opinion before making a decision.

All contents are based on our understanding of HMRC legislation, which is subject to change.

Other Insights

Arranging life insurance for a married couple to cover their £3 million inheritance tax liability

The clients, a married couple in their 60s, had three children in their 20s The couple had a £3 million inheritance tax (IHT) liablity They were seeking whole-of-life cover for their joint life IHT [...]

New pensions taxation rules

In this video, Director Paula Steele explains how the taxation of pensions could change from April 2027. Please click here to view the full video

Changes to IHT

In this video, John Lamb Hill Oldridge Director Paula Steele summarises the proposed changes to inheritance tax that were outlined in the Budget in October 2024. Please click here to watch the full video [...]